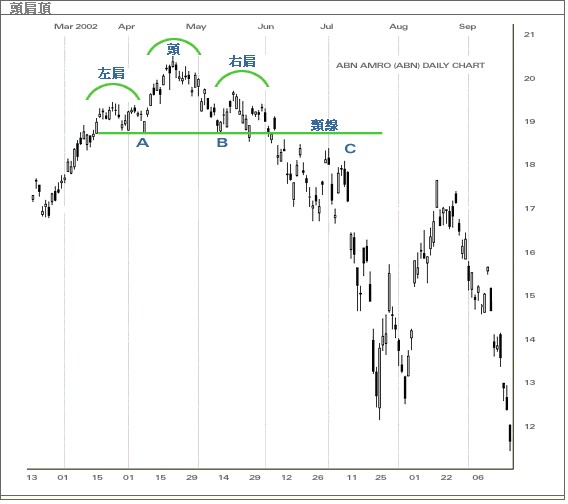

頭肩頂(Head & Shoulders Top)是最為常見的倒轉型態圖表之一。頭肩頂跟隨上升市勢而行,並發出市況逆轉的訊號。顧名思義,圖形以左肩、頭、右肩及頸線組成。當三個連續的股價形成左肩時,其成交量必需最大,而頭部次之,至於右肩應較細。 當股價一旦跌破支持線(頸線),便會出現較急且大的跌幅。 成交量可為頭肩頂形態充當一個重要的指標,大多數例子中,左肩的升幅必定高於右肩的升幅,下降的成交量加上頭部創新高可充當一個警號,警戒市勢正在水平線上逆轉。 第二個警號是當股價由頭部的頂峰回落時,穿越右肩的高點。最後逆轉訊號是在股價跌破頸線後,出現「後抽」現象,在股價觸及頸線後仍未見有所突破便立即沽出。

在大多數圖形中,當支持線被穿破,相同的支持線在後市中轉變為阻力線。 |