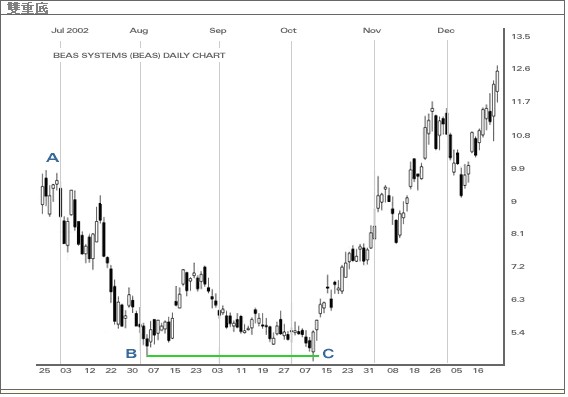

雙底(Double Bottoms)俗稱W底。它是當價格在某時段內連續兩次下跌至相約低點時而形成的走勢圖形。當出現雙重底時,通常是反映在向下移動的市況由熊市轉為牛市。一旦形成雙重底圖形,必須注意圖形是否肯定穿破阻力線,若穿破阻力線,示意有強烈的需求。成交量通常因回調而大幅增加。雙重底亦可利用技術分析指標中的資金流向指數及成交量平衡指數(OBV)作分析買賣強勢之用。若股價穿破阻力線,阻力線因此而變為支持線。

根據以上圖例,由A點到B點是一個下跌趨勢。當價格下跌遇到支持位後,隨即反彈徘徊在這交易範圍約兩個月。在C點,價格又再嘗試上一個低位B點,但即時反彈。其後,因雙重底的形成。價格隨即迅速上揚。要確認,必須先肯定趨勢是否真正轉向或是否已破前市的阻力位(即A點)。 |