|

Prosticks Articles

Hong Kong Economic Journal --- 4 Dec, 2000

Be Cautious of False Breakouts for Moving Averages

Moving average is one of the most popular technical

analysis tool used by practitioners. Conventional wisdom

dictates that when price closes above the Moving Average,

one should go long. On the other hand, when price closes

below the average, one should go short. In the long run,

this is a very profitable strategy. However, at times when

the market is consolidating, price tends to fluctuate

above and below the average randomly, causing the strategy

to suffer from losing streaks.

Nevertheless, the Moving Average is a very useful

benchmark of support and resistance levels. When price

breaks above or below it, it means the resistance or

support is breached and a trend should then follow.

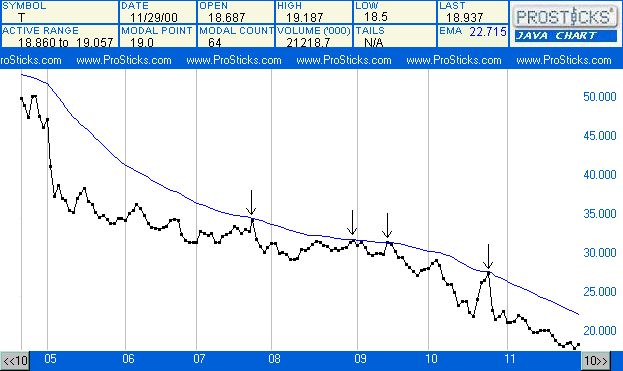

Figure 1 shows the Modal line chart of AT&T

(Symbol: T). AT&T is the biggest telephone company in

US, just like the PCCW in Hong Kong. Compared to the

historical high of 62, the current price level has already

dropped nearly 70%. The 40-day exponential moving average

is also shown in the figure. However, unlike the

traditional moving average, the moving average in the

diagram is calculated using Modal Points instead of

closing prices. The official Prosticks website allows the

users to specify whether to calculate the moving average

using closing prices or Modal Points.

It seems that there is a regional preference with

regards to the choice of Moving Average parameters. In

Hong Kong, people like to use 50-day Moving Average, while

in the United States, 40-day is more preferred than

50-day. There is no theory to account for the cultural

differential, just a regional custom.

Refer to Figure 1 again, notice how powerful the Moving

Average acts as a resistance level to the downtrend.

Whenever price rebounds from a low price to the Moving

Average, severe selling pressure resurfaces and the

downtrend resumes. (see the places marked with arrows in

the figure).

Thus, from this chart, we see that the Moving Average

has been imposing significant resistance to price all the

way throughout the downtrend. We should then deduce that

the average should continue to act as a resistance to

price in the future. As such, not until the subsequent

Modal Points can manage to break above the average, the

trend is still down.

Though the Figure shows that the Modal Points never

rise above the average, if we look at the Candlestick

chart of this stock (not shown here), we will see that at

times the day high or close of some bars temporarily

breaks the average, creating false breakouts? Thus, if one

adopts the Moving Average breakout strategy in trading,

one should wait until the Modal Point breaks the average,

rather than merely the day high or day close.

|