|

Prosticks Articles

Apple Daily --- 10 Sept, 2000

Market Prediction with Modal Count

Last time we discussed the time approach to calculate

Prosticks parameters. Under the time approach, the Modal

Point is defined as the price which the market has spent

the most time trading. It is not necessarily the price

with the highest volume traded on it, but rather, the

price which the market has traded with the highest

frequency. We also explained that Modal Points calculated

using the time approach have more predictive power since

they do not have the deficiencies of the volume approach.

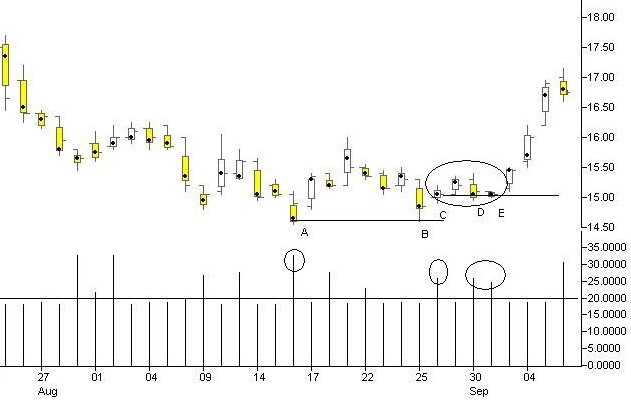

Prosticks charting has an indicator called the Modal

Count which records the amount of time the market spends

trading at the Modal Point. Refer to Figure 1 which shows

the Prosticks chart of SmarTone(0315). The upper pane

shows the conventional Prosticks chart while the lower

pane shows the corresponding Modal Count indicator. As can

be seen, the Modal Count plot looks similar to the

traditional volume plot. The vertical lines represent the

number of 5-minute intervals the market has spent trading

at the Modal Points. Thus, if the Modal Count for a day is

20 units, it means that during that day, there are 20 five

minute intervals the market has traded at least once at

the Modal Point. The horizontal line in the plot is the

150-day average of the daily Modal Count. Thus, if the

Modal Count is above the 150-day average, it means the

market has spent more than a normal amount of time trading

at the Modal Point.

Remember, the Modal Point is the price where the bulls

and bears trade actively with each other. The more time

the market spends at the Modal Point (and thus the higher

the Modal Count), the more severe is the tug-of-war

between the two parties.

Refer to Figure 1. Notice that bar A has an

exceptional high Modal Count. That day, the Modal Point is

located at the bottom of the bar and finally the market

rallied all the way up and closed above the Active Range

and Modal Point. The large Modal Count value signals that

the market had consolidated a long time at day low before

finally the buying forces exhausted all the selling forces

and propelled price strongly upwards. Market bottoms often

behave like this. As can be seen from the figure, when a

few days later, price fell to A's Modal Point again

at B, those buying forces at A resurfaced

and pushed price upwards from B.

Consider the bars circled in the figure. Notice that

bar C, D, and E all have the same Modal

price, forming a Modal Platform. Notice that all their

Modal Count have high values, higher than those of their

nearby bars as well as above the 150-day average.

Therefore, we know that there was a fierce battle taken

place between the bulls and the bears at C, D,

and E three days in a row at the same price. When

we see this phenomena, we know that once either the buy or

sell side is exhausted, the market will explode in either

way. Notice that all of the Modal Points at C, D

and E reside inside the Active Range of B,

another indication of an extreme tight market situation.

As expected, the next day after E, the market

opened above the Modal Platform and then surged

dramatically over the next few days.

Thus, on market tops or bottoms, when streaks of high

Modal Count values occur, a correction or rebound is near.

Please note that the Modal Count indicator can only act

as a supporting reference. Unlike traditional indicators

such as RSI or Stochastics, the Modal Count indicator

contains much noise and thus should be used with caution.

Suppose during a day, the market is extremely quiet and

inactive ahead of holiday with little news, price should

then trade in a very tight range. In this case, the Modal

Count will also be very high, but without much significant

implications. Modal Count concepts only apply to trending

markets, especially when the market is near the top or

bottom.

The Modal Count concept can also be used to predict the

Modal Point of the whole day. To give an example, suppose

the 150-day Modal Count average is 20 units. On a day, we

see that the Modal Count is already 30 units and the

intraday Modal Point is at $13. In this case, even though

the market is not closed yet, we can comfortably conclude

that for the rest of the day, the Modal Point will remain

at $13. For those who want to range trading, they can use

$13 as the benchmark center point to buy low? and sell

high?

|