|

ProSticks Articles

Apple Daily --- 25 June, 2000

Avoiding Technical Traps Using Active

Range

Every investor appreciates the importance of volume. Volume measures the

strength of the market. If the market rises but the rise is not accompanied by volume, the

market lacks strength and the rally may not be sustainable in the near future.

The advantage of the ProSticks Charting System is that it incorporates volume

information on the price-time dimension. The Active Range, which is the

body of the ProSticks bar, indicates the range where nearly 70% of the

total volume had transacted.

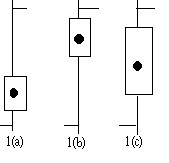

The first figure shows three scenarios of a ProSticks bar. In 1(a), the Active

Range is located on the lower half of the bar, while in Figure 1(b), the Active

Range is situated on the upper half. Thus, we know that for the former, most

of the volume was concentrated in the higher prices while in the latter, most transactions

occurred at the lower prices.

In 1(c), the Active Range is symmetrical which indicates that the volume

was evenly distributed along the day range. For a strong rallying day, a symmetrical

Active Range indicates that buying orders flow into the market continuously

throughout the day as the market keeps on rallying higher and higher.

As such, the Active Range can be used to detect potential technical traps

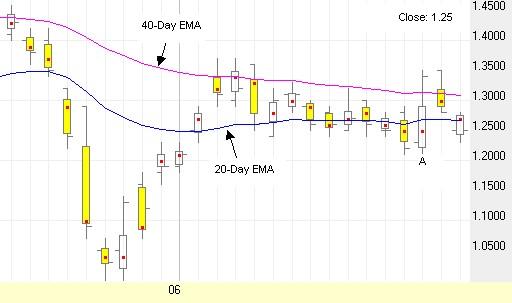

Consider the below ProSticks chart of Culturecom Holdings (0343). Notice that

bar A is a very long bar which closed near the day high. Furthermore, it

closed above the moving averages and exceeded all the highs of nearby bars.

Thus, bar A is very bullish, if we only consider the information offered by the traditional

Bar and Candlesticks charts.

Unfortunately, for the following few days, the market lacked a follow through and

the market fell back below the moving averages. Bar A is what we call a technical

trap.

Now consider the Active Range of A. Notice that though the price rallied and

closed strong, the Active Range was situated in the lower half of the

bar range and well below the 40-Day moving average. The late rally is thus suspicious

and was not accompanied by volume. In short, the divergence between volume and

price shows that the market lacked strength for this particular day.

It is still premature to conclude whether the stock will assume a

downtrend. However, had investors consulted the ProSticks chart and noticed the

divergence between the Active Range and the price, they would have hesitated before longing

the stock at A, despite its apparent bullishness during that day.

Those familiar with the Market Profile theory by J.Peter Steidlmayer will realize that the

Active Range is actually the value area in the profile diagram.

|